1. What are the stars and their meanings used in the fund ratings?

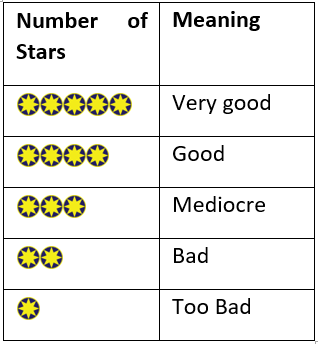

Ludens uses a multidimensional scientific method to rate funds. Stars constitute a summary of the results of various analyses of risk-adjusted performance of the funds and the sustainability of this performance. Our goal here is to express an indication of the results of the analysis that the user can easily understand and use. Fund ratings range from 1 to 5 stars and are explained in the following table:

As seen in the table, if a fund is rated five-stars, this means that the fund placed as one of the most successful funds in its fund category. In other words, the rates in the corresponding period of this fund is very good and it placed at one of the top positions in the rankings.

2. How often are the fund ratings updated?

Fund ratings are updated on a monthly basis. They are recalculated at the end of each month and the stars formed accordingly are published on our website in the following month.

3. Which funds can have a Ludens rating?

Both mutual funds as well as pension funds can have a Ludens rating.

4. What are fund categories?

Funds are initially divided into categories when rating. In the creation of fund categories, the investment strategies of funds and distribution of the benchmark portfolio announced by the fund should be primarily taken into account. Thus, for example balanced, shares, funds, public debt etc categories are established for pension funds. Investment strategies of funds in the same category are similar. Thus, the fund itself is compared with similar funds and funds are given star ratings

In order for a rating to be determined according to Ludens methodology, there has to be enough funds with past 156 weekly price data in a fund category. In addition, some fund categories (liquid, gold, etc.) cannot be examined in the context of the Ludens rating method.

5. Is risk taken into account in Ludens fund ratings?

Yes. Ludens rating method does not act only on the returns while determining the performance of funds; it also takes into account the other key element of investment that is risk.

6. Which elements are taken into account in fund ratings?

Mainly two criteria are taken into account in the Ludens rating methods:

- Based on risk-adjusted performance: It shows the success on the fund’s management in terms of return-risk context.

- The persistency of performance: indicates whether the success of the Fund is consistent or not.

Ludens rates the funds by combining both criteria.

7. I cannot see ratings of the funds I am interested in on your website. Why is that?

A fund must have at least three years of historical price data to be rated according to Ludens rating methodologies. Therefore the fund you are interested in will not be rated unless it has a history of more than three years.

Another reason can be the lack of enough funds in the category to form the basis for a rating. In order for a rating to be determined according to Ludens methodology, there has to be enough funds with past 156 weekly price data in a fund category. In categories that do not fulfill these conditions there are no ratings.

8. The fund I am interested in appears to be "non-rated." What does this mean?

Ludens gives importance to the results of analysis conducted for the rating to be adequate and sufficiently explanatory. If the findings on a fund does not provide evidence of some critical values regarding the reliability and explanatoriness of our analysis, we believe it would be misleading to rate this fund with others. Therefore, this fund is not designated a star rating. As background information only, the alpha and Hurst coefficient are given with the statement “non-rated” beside it.

9. How do I use the fund ratings?

Fund ratings are an easy to understand, easily accessible and impartial source of information on how the accumulations of participants are evaluated. Hence, participants can easily follow the degree of success of their fund by looking at fund ratings. Fund ratings are in the nature of recommendations as to whether participants should keep their accumulations in the same fund.

For all investment securities and in turn naturally for investment in funds, there is no guarantee that the fund will achieve the same returns obtained in prior periods. Grades obtained from fund ratings are given according to the success of the fund in the previous periods, and it is unclear whether they remain the same in the future. Investors considering buying or thinking of changing funds can only obtain an idea of the past performance of the funds by looking at their fund ratings. In this sense, information obtained from fund ratings is only advisory and in no degree constitutes a guarantee nor is of binding nature.