LUDENS ADVANCED FINANCIAL SERVICES AND CONSULTANCY LTD. RATING METHODOLOGY

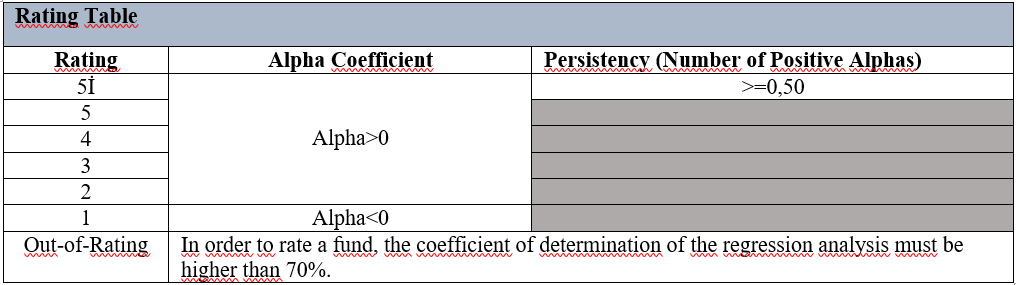

- Based on risk-adjusted performance (alpha)

- Persistency of performance

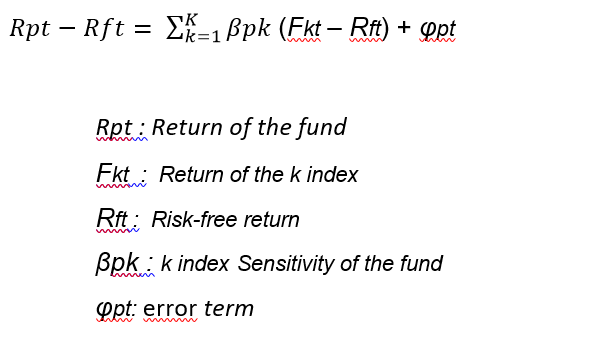

Risk-adjusted performance (alpha):The main focus of this method is to identify specific performance which arises from the fund manager’s skills. The main goal here is, to isolate the effect of dominant position in the financial markets over the total fund performance. For answering this purpose, it’s set off from the return-based style analysis which was basically developed by Sharpe. This analysis simply can be expressed as finding the weighted average of the market indices set which has the closest returns to the returns of the analyzed fund. Starting from the style analysis, performance of the portfolio can be expressed as follows:

Alfa is the criterion of the performance which arise from the management skills of an actively managed fund.

The returns used in the application are weekly and analysis period is 3 years. As it is seen from the above statement, the risk-free return is eliminated from the returns. In addition, since the essence of the methodology is about to determine the performance of the manager, calculation of the returns regulated accordingly and costs which cannot be controlled by manager (Pension company’s share in fund operation costs, notary etc.) are excluded from the calculation.

In order to make rating, there must be at least 10 funds in a fund category with 156 weeks of historical price data. Independent variables in the regression analysis (indexes) are selected in such way that they overlap with the all asset groups which invested in by the funds in that category.

If the adjusted coefficient of determination which obtained from the regression analysis is below 70%, the fund left out of processing.

The persistency of performance:

Although a fund’s providing positive alpha for a given period is a significant criterion on its own, the persistence of this situation is thought to be one of the distinguishing characteristics for investors. Accordingly, the secondary focal point of the method is persistence of performance. The performance in question for which persistence is sought after is the performance based on management skills of fund managers in the light of the explanations in the first part. And the criterion used for this purpose is the number of positive alphas of the fund. When calculating this criterion, the past 156 week (3 years) alpha series of the fund is used. If more than 50% of 156 alpha is positive, this fund is a persistent fund.

When determining the number of stars in the ratings, primarily funds are divided into two groups in terms of their positive and negative ‘alpha values’. 1 star is given to negative alpha funds. Funds with positive alpha are ranked according to their alpha size. This group of funds is then divided into four equal parts. These funds are given 5, 4, 3 and 2 starts starting with the first part. Then the persistency criteria is applied to the 5 star-funds. Funds that meet this criterion are assigned the phrase “5i”. Although it has 5 stars, there are funds that cannot be analyzed due to lack of data. These funds are given 5 stars and there is an explanation next to the fund related to this situation.